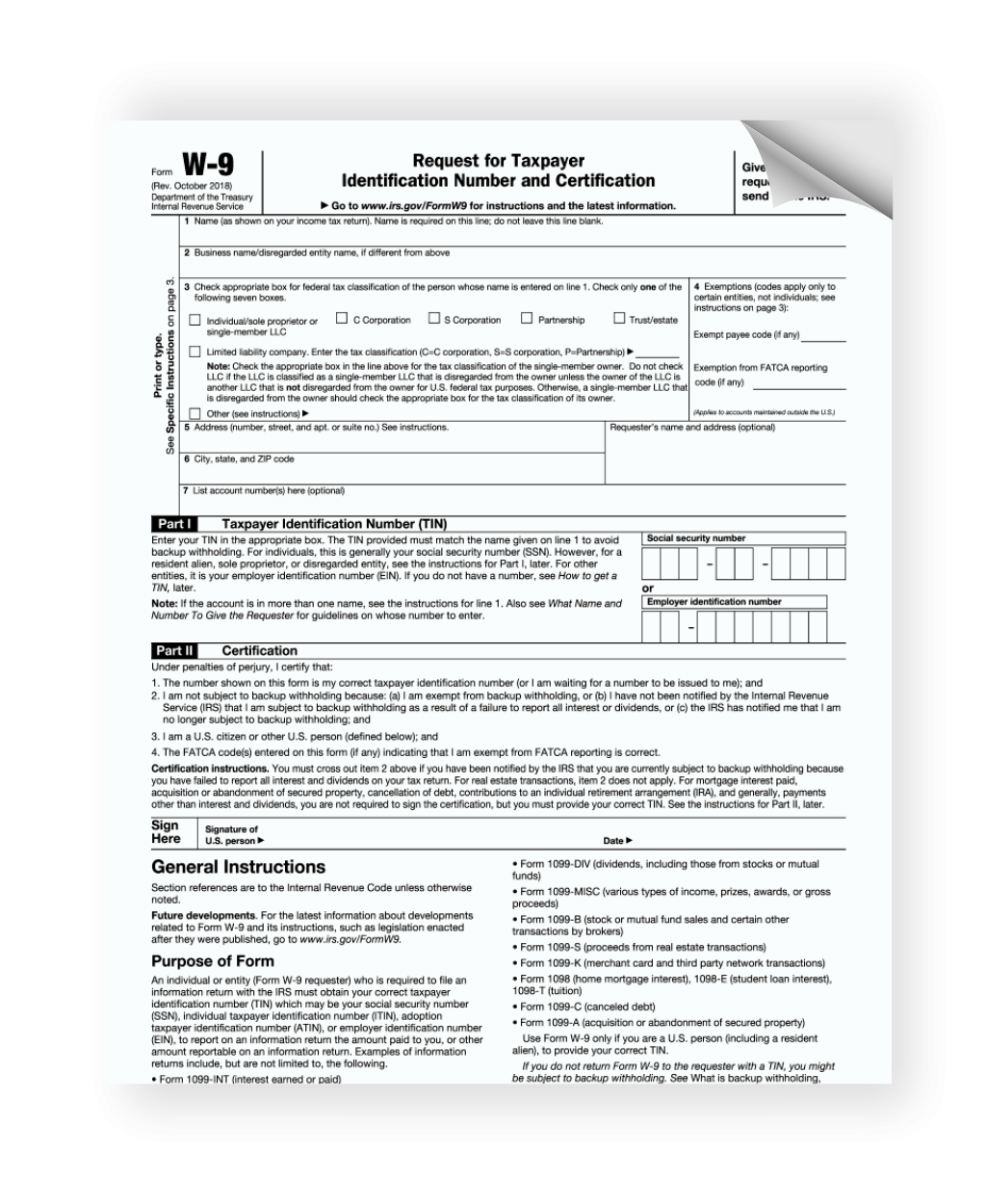

Are you looking for an easy way to update your tax withholdings? With the IRS Form W-4 Printable, you can make adjustments to ensure you’re not overpaying or underpaying your taxes. This form is essential for employees and employers to get the right amount of taxes withheld from paychecks.

By filling out the IRS Form W-4 Printable correctly, you can avoid owing a large sum of money at tax time or receiving a smaller refund than expected. It’s crucial to review and update this form whenever you experience life changes, such as getting married, having a child, or getting a new job.

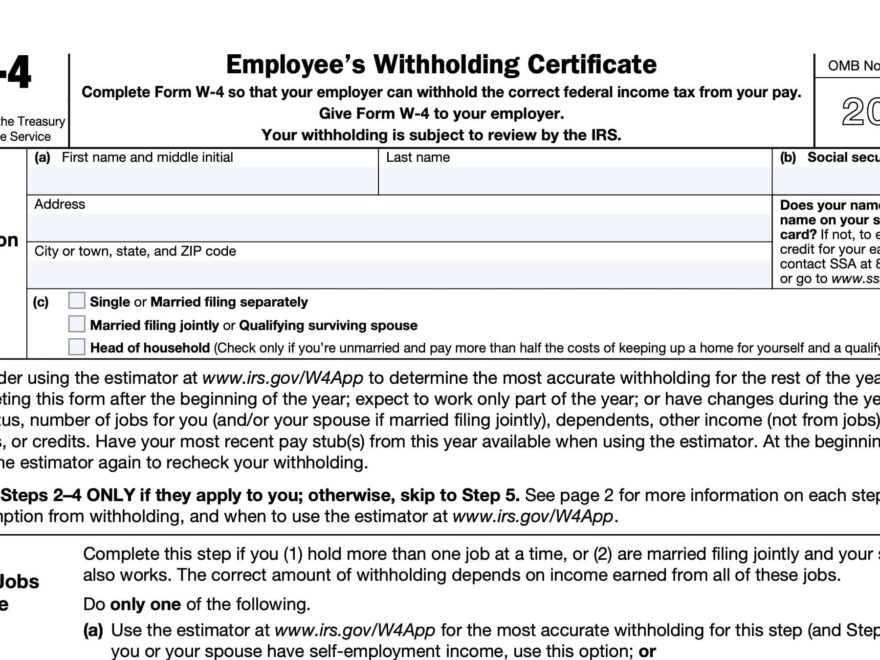

Irs Form W-4 Printable

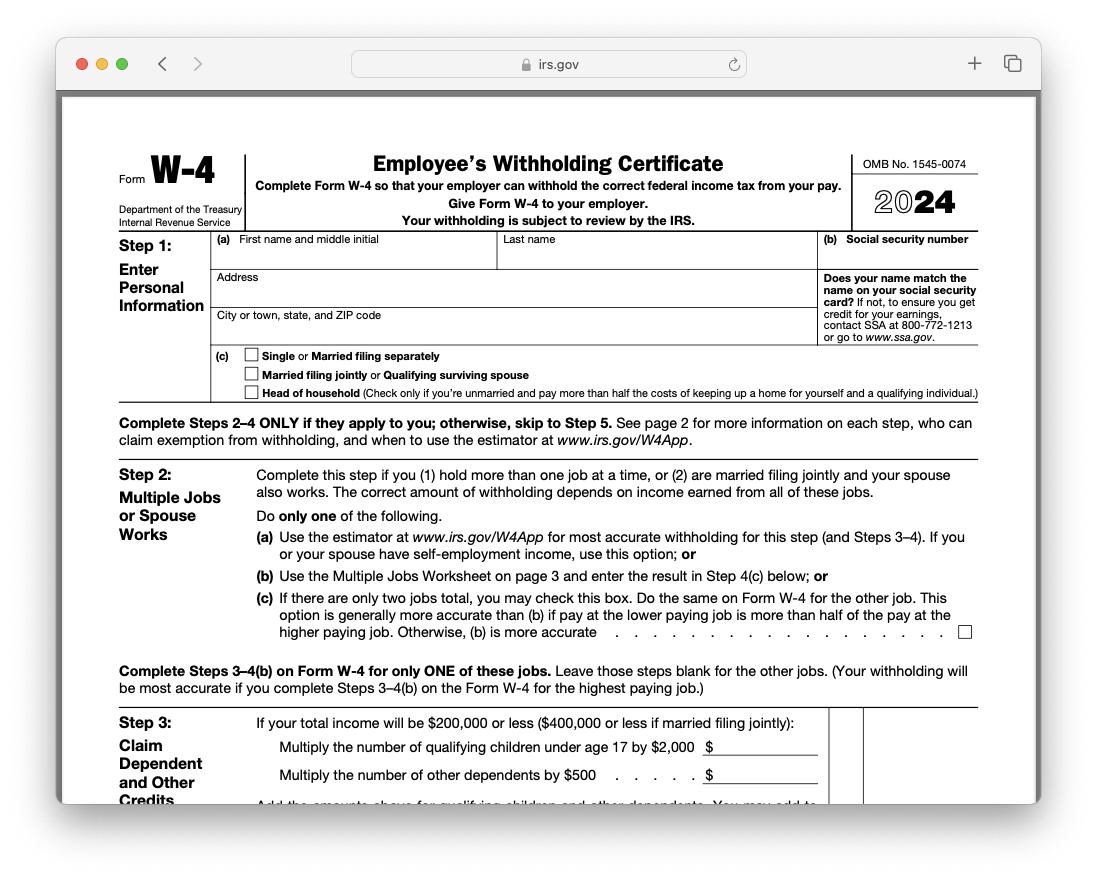

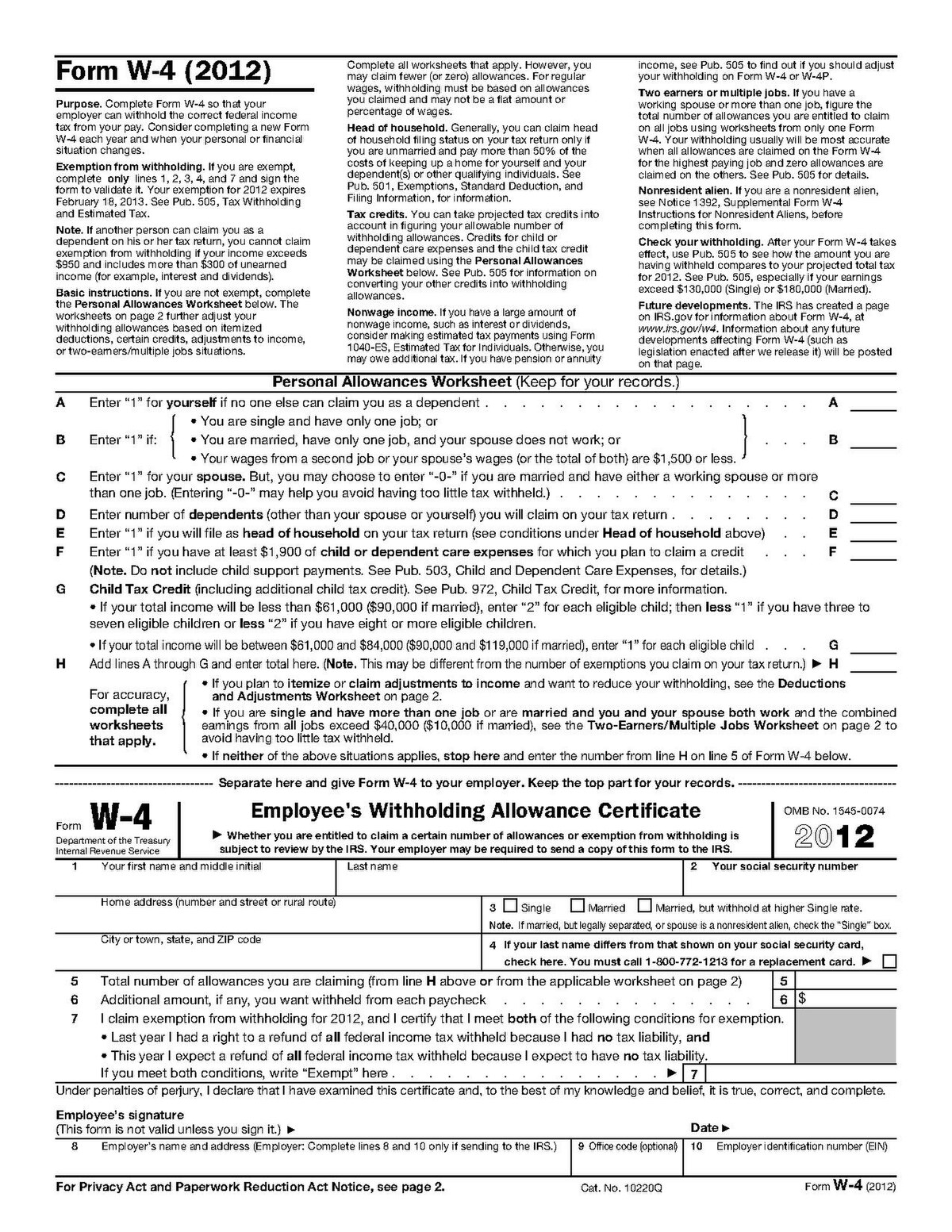

How to Access and Fill Out the IRS Form W-4 Printable

First, you can easily find the IRS Form W-4 Printable on the official IRS website. Once you have the form, carefully follow the instructions to complete each section accurately. Make sure to provide all necessary information, including your name, social security number, filing status, and any additional income.

When filling out the IRS Form W-4 Printable, you’ll also need to indicate how many allowances you want to claim. The more allowances you claim, the less tax will be withheld from your paycheck. Be sure to use the IRS withholding calculator to determine the appropriate number of allowances for your situation.

After completing the form, remember to sign and date it before submitting it to your employer. Your employer will use the information on this form to calculate the correct amount of federal income tax to withhold from your pay. Keep in mind that you can update this form at any time throughout the year if your circumstances change.

With the IRS Form W-4 Printable, you can take control of your tax withholdings and ensure you’re not caught off guard come tax season. By staying informed and updating this form as needed, you can avoid any surprises and keep your finances in check.

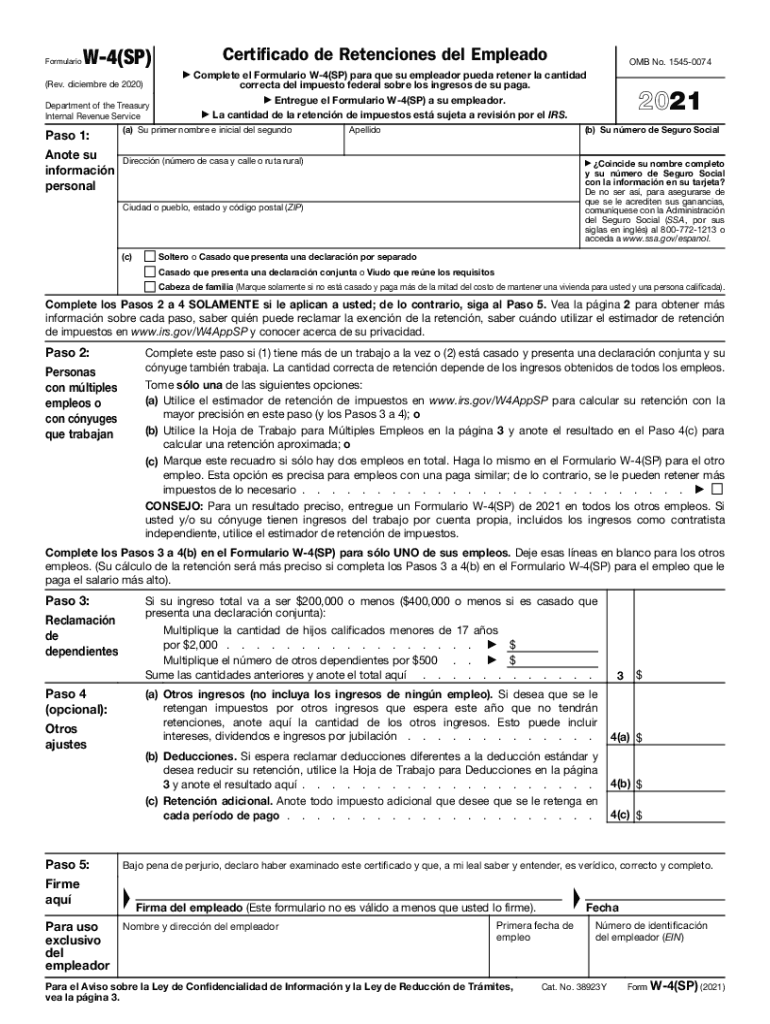

W4 Form 2024 Spanish Fill Out Sign Online DocHub

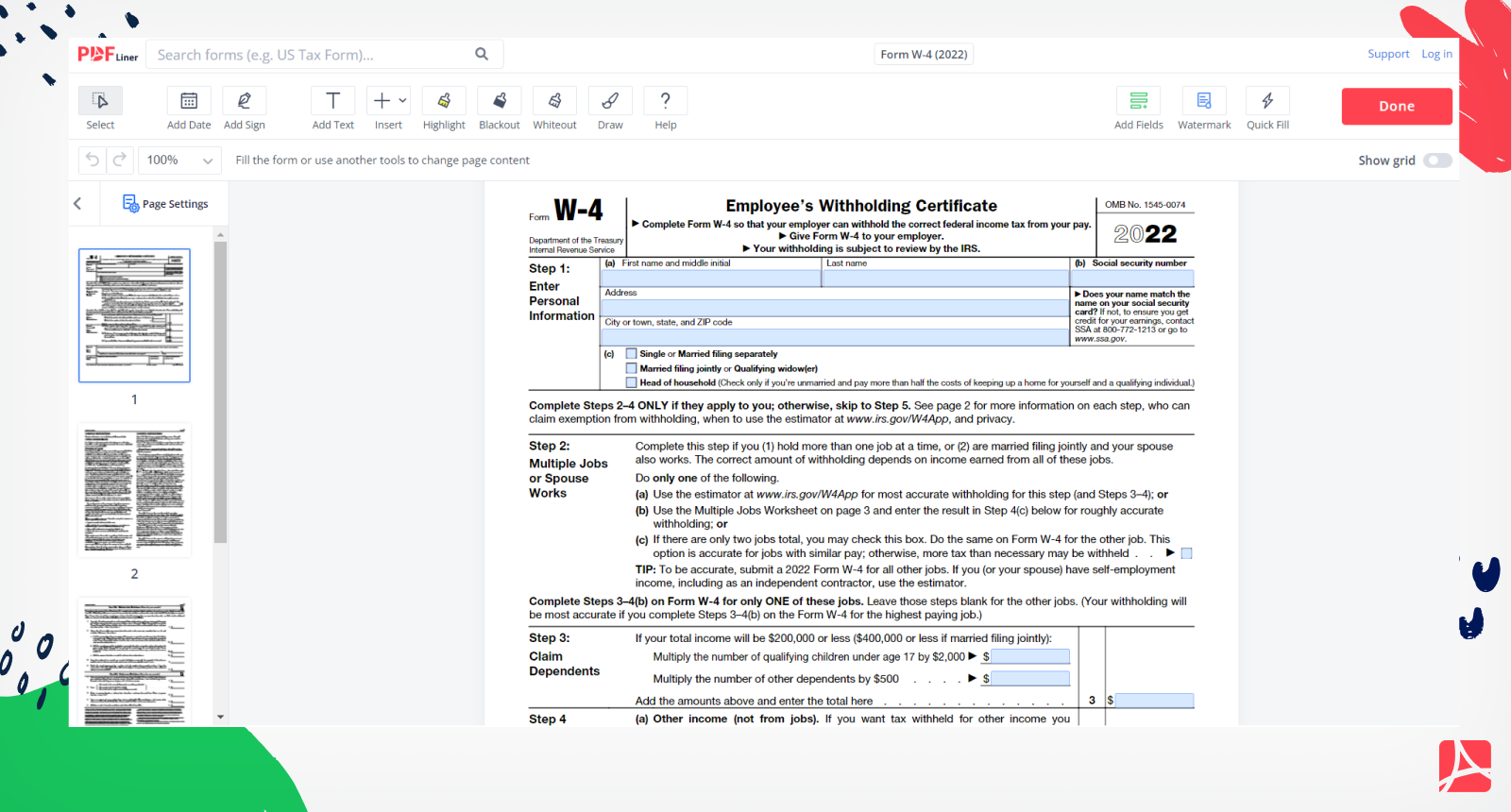

Form W 4 2022 Print And Sign W 4 Form Online PDFliner

Useful IRS Forms

Form W 4 Wikipedia

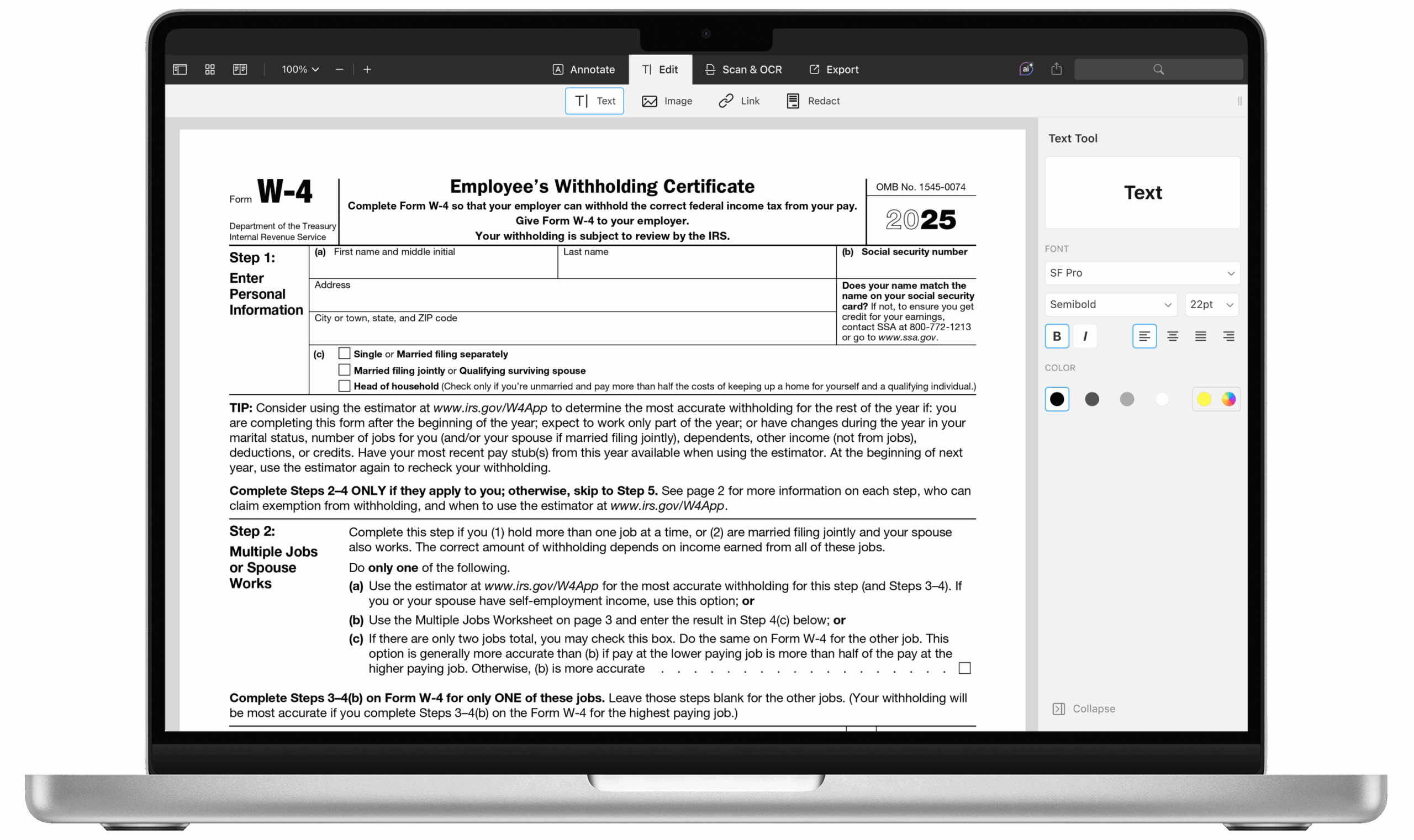

How To Fill Out IRS W4 Form 2025 PDF PDF Expert