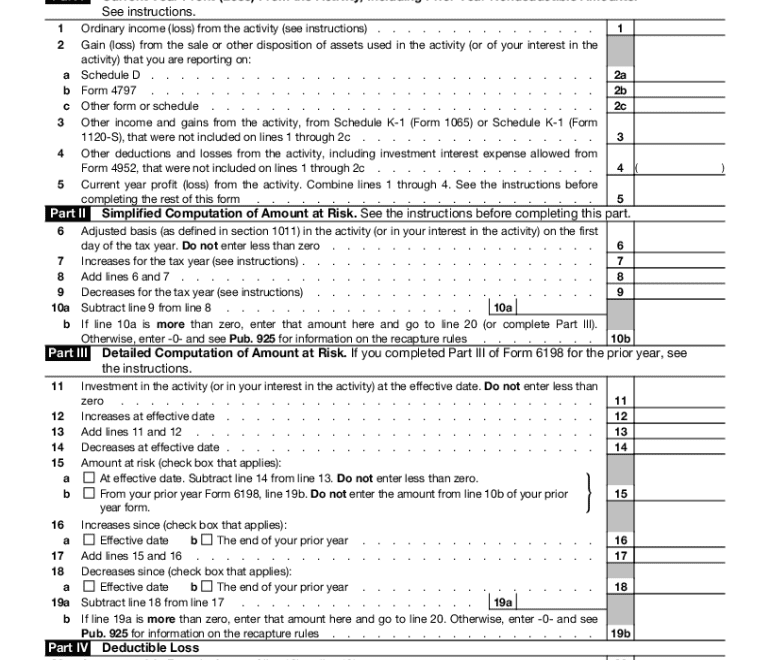

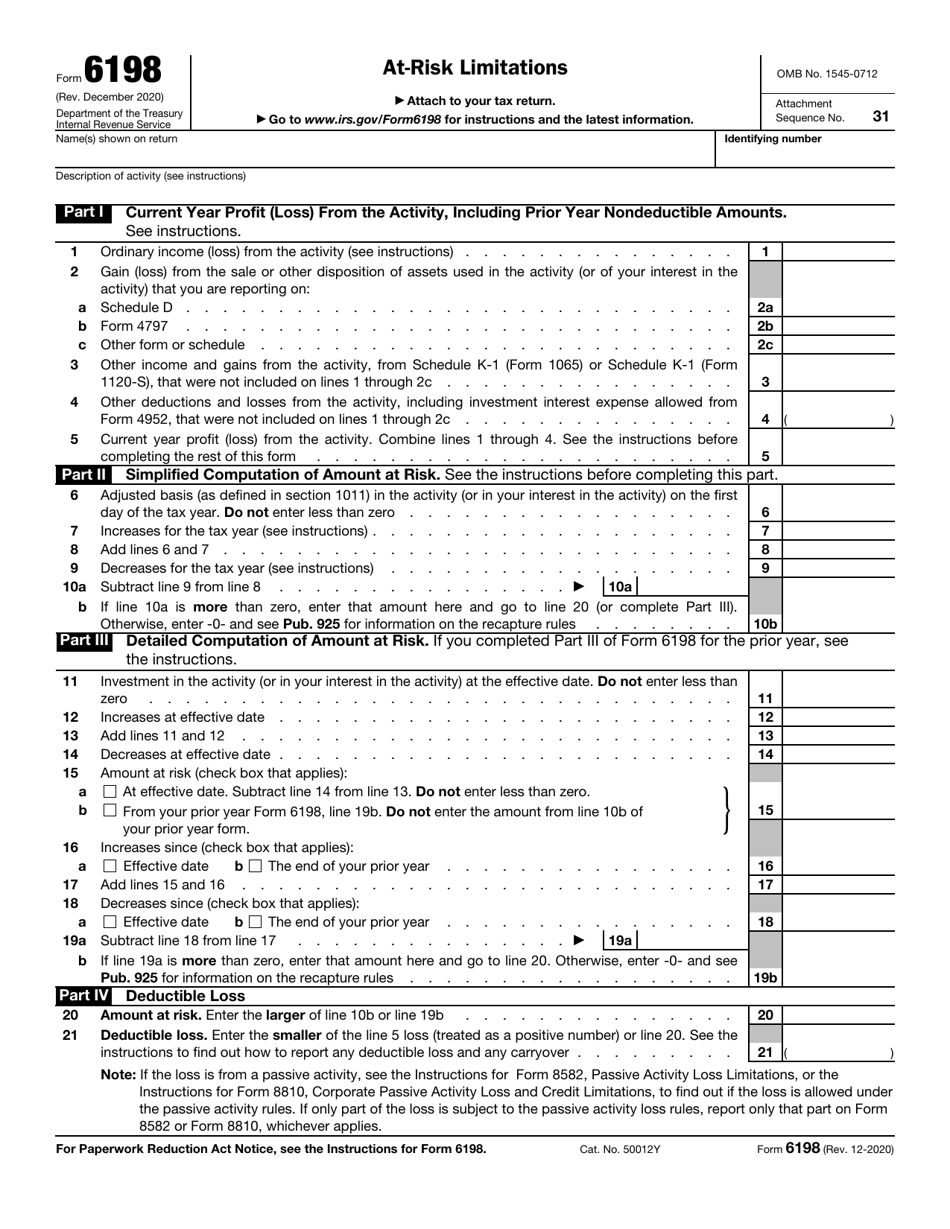

Are you looking for a hassle-free way to manage your tax deductions and credits? Well, look no further because we have the perfect solution for you. IRS Form 6198 Printable is here to make your tax filing process a breeze.

With IRS Form 6198 Printable, you can easily report any at-risk activities in your business, ensuring that you are compliant with IRS regulations. This form allows you to claim the deductions and credits you are entitled to, without any confusion or stress.

Irs Form 6198 Printable

Maximize Your Tax Benefits with IRS Form 6198 Printable

By utilizing IRS Form 6198 Printable, you can maximize your tax benefits and minimize your tax liability. This form is designed to simplify the process of reporting at-risk activities, making it easier for you to claim the deductions and credits you deserve.

Whether you are a small business owner or a self-employed individual, IRS Form 6198 Printable is a valuable tool that can help you save time and money during tax season. Don’t let complicated tax forms overwhelm you – simplify your tax filing process with IRS Form 6198 Printable.

So why wait? Download your free copy of IRS Form 6198 Printable today and take the first step towards maximizing your tax benefits. With this easy-to-use form, you can ensure that you are taking full advantage of all available deductions and credits, making tax season a breeze.

In conclusion, IRS Form 6198 Printable is a valuable resource for anyone looking to streamline their tax filing process and maximize their tax benefits. Don’t let complicated tax forms stand in your way – download IRS Form 6198 Printable today and take control of your tax deductions and credits.

3 11 3 Individual Income Tax Returns Internal Revenue Service

Form 6198 Irs

IRS Form 6198 Download Fillable PDF Or Fill Online At Risk Limitations 2009 2025 Templateroller

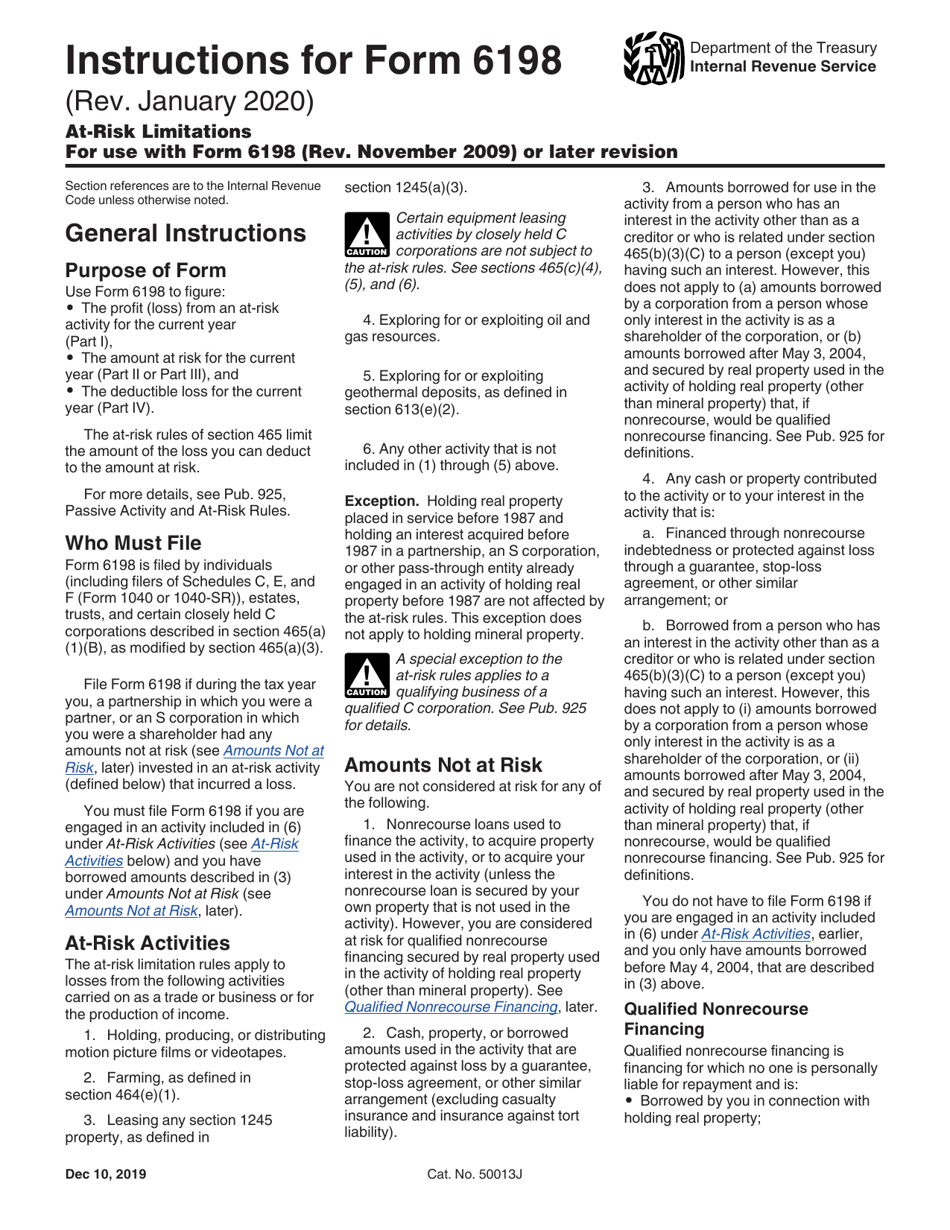

Download Instructions For IRS Form 6198 At Risk Limitations PDF 2009 2025 Templateroller

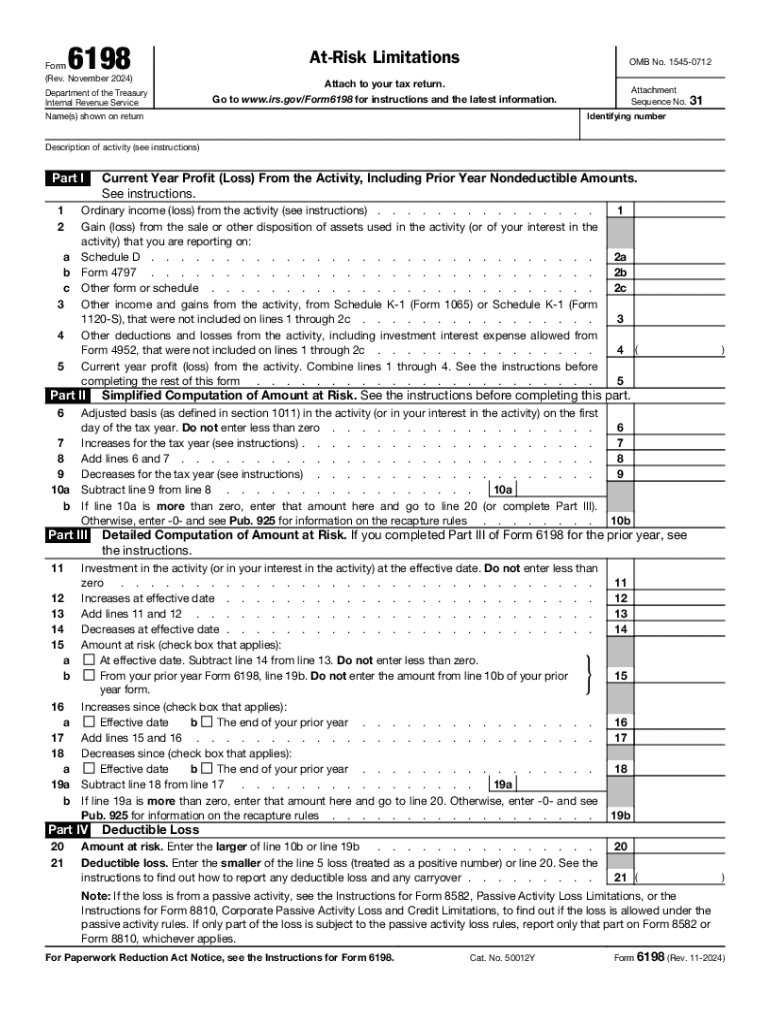

2024 Form IRS 6198 Fill Online Printable Fillable Blank PdfFiller